Investment |

December 09, 2019Good Time to Invest in ELSS

Tax saving is one important part of our financial career, managing tax efficiently is an art, if you can expertise that most of your financial issues could be resolved. When it comes to saving taxes most of us wait till the month of March because we continue our habits to push everything to the last day of submission like our school time assignment. Most of us end of in the paws of wrong products just because we want to get over with this. This specially happens to the investor who have just started working and may not have much knowledge about investment or tax saving.

So before taking any decision further, please review one of the most popular tax saving option i.e. tax saving mutual funds.

Mutual fund has become the top choice for the investors when it comes to fulfil their financial goals.

What is ELSS?

Meaning of ELSS is Equity Linked Savings Scheme; it’s a category of mutual fund which helps in saving taxes. ELSS offers you dual advantage of capital appreciation as well as tax saving under section 80 C of Income Tax Act. ELSS fund comes under equity category (open ended) which means more than 65% of the money is invested in equity. One can save taxes upto Rs.46,800/- (Considered 30% tax bracket including cess) under section 80 C. ELSS fund have two options of investment:

- Growth

- Dividend (includes dividend reinvestment and dividend pay-out)

An individual is not liable to pay tax on the dividend received from mutual fund if the amount is below Rs.10 lakh. But if the amount exceeds this limit the investor has to pay 10% of the total earnings as tax during a particular year. On the flipside, the government has made it mandatory for companies and mutual fund houses to deduct taxes from the dividends distributed before disbursing them under section 115-O of the The Income Tax Act,1961.

Features of ELSS funds

Lowest lock in period

There are other tax saving products available in the market like PPF, NPS or FDs and so on, however all these products have a lock in period of more than 5 years. ELSS is one such product which gives you tax benefit with just a minimum lock in of 3 years.

Tax Saving

ELSS is a kind of mutual fund which provides deduction of upto 1.5lakhs from total income under section 80C.

Dividend and Growth

One can choose to invest in either dividend or growth option depending upon the requirement of money. In growth option money is re invested and keep on growing till the time you redeem it, whereas dividend is being paid out in dividend payout option.

Advantage of ELSS Funds

- Just 3 years of lock in

- The portfolio in which the will be invested is transparently available to all the investors.

- Once the invested money completes 3 years of lock in period, you can with draw 100% of it.

- ELSS provides you flexibility to invest via SIP or lump sum mode.

- The returns regenerated by ELSS funds are comparatively better than in competitor products. However the comparison of ELSS and other products are depicted below.

- There is no maximum limit for investment in ELSS even once you tax limit is exhausted , one can still invest in ELSS only thing is taxes can be saved up to Rs. 46,800/- under section 80-C of the Income Tax Act, 1961.

Disadvantages of ELSS Funds

- ELSS is equity linked investment; there is no way one can avoid exposure towards equity in so it’s not suitable for conservative investors.

- The money which you received after 3 years of lock in period will be taxable as per Long term capital gain tax.

- The returns are not guaranteed, any investment in mutual fund doesn’t guarantee returns.

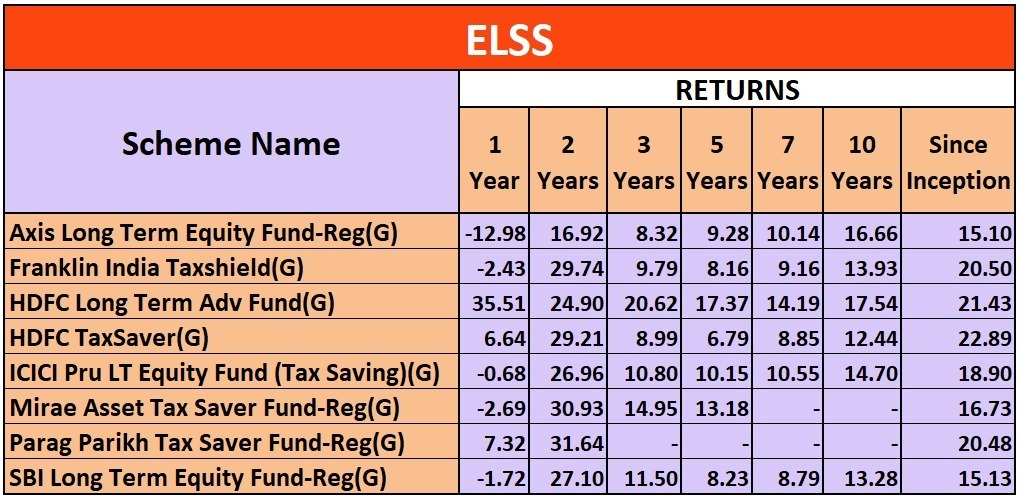

Top ELSS Tax Saving Funds for FY June 2022

Note: Returns data is based on NAV (Net Asset Value) of direct-growth variant of the schemes as recorded on June 2022