Mutual Fund |

July 28, 2022What are Flexi-Cap Funds? How is it different from Multi-Cap Funds?

The Asset Under Management (AUM) of the Indian MF Industry has grown from ? 6.80 trillion as on April 30, 2012, to ?38.04 trillion as on April 30, 2022, more than 5.5-fold increase in a span of 10 years. Along with this, the mutual fund industry has crossed a milestone of 10 crore folios during the month of May 2021. The industry comprises various Asset Management Companies (AMCs) that offer a variety of schemes to the investors like equity-oriented, debt-oriented, hybrid, gilt, money market, etc. One such type of scheme that has been recently introduced in India is called flexi-cap funds. In this article, we will try to understand such schemes and how they are beneficial for investment.

What Is Flexi-Cap Fund?

Flexi-Cap Fund is an open-ended, dynamic equity scheme. It invests across companies of any market capitalizations i.e., large-caps, mid-caps, and small-caps companies. Such type of funds allows the investors to diversify their portfolio and alongside mitigate risk, reduce volatility and generate good returns. Unlike other funds like large-cap, mid-cap or small-cap funds which need to invest in companies restricted to their specific market capitalization size, flexi-cap funds offer the fund manager to be flexible and pick any stock from the benchmark to be included in the portfolio.

Flexi-Cap Funds vs Multi-Cap Funds

- As per regulation, a Multi-cap Fund has to invest at least 75% of its total assets in equities and in case of a Flexi-cap Fund, it has to invest a minimum of 65% of its assets in equity and equity-related instruments.

- For a Multi-cap fund, the investment has to be minimum 25% in large-cap, minimum 25% in mid-cap and minimum 25% in small-cap companies. But in case of a Flexi-cap Fund, there are no minimum threshold for investments in large, mid and small cap.

- A Multi-cap Fund is required to maintain the equity allocation regardless of the market conditions whereas a Flexi-cap Fund provides its fund manager better flexibility to explore investment opportunities and churn the portfolio whenever they want.

Advantages of Flexi-Cap Funds

- It can grab opportunities across the entire market spectrum like market capitalization, sector, style of investing, etc.

- There is always a battle between risk and returns in the markets. Flexi-cap funds have a unique approach to balance the risk and returns in the market to ensure that the invested capital stays safe and fetches good growth.

- Flexi-cap funds can be referred to as ‘all weather investing’ because there is complete freedom given the fund manager and based on the market cycles and swings, the AUM can be allocated accordingly to avoid any downsides and volatility.

- It is one of the best equity investment avenues for investors who have a moderate to high risk profile with a long-term approach for investing.

- Another big advantage is that they are dynamic in nature. If a particular theme or style of investing seems no longer profitable, the fund manager can modify or change the style that seems to fit in the current market environment.

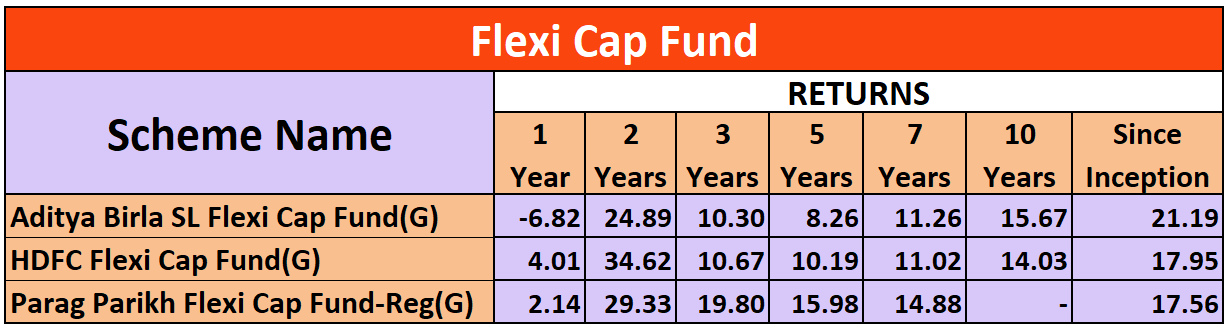

Top 3 best Flexi cap Funds based on the past Returns: